Should You Use Debt to Grow Your Business? Pros & Pitfalls

That question keeps a lot of new entrepreneurs up at night. You’re told that fast growth requires capital but that capital often comes with interest, personal risk, and expectations you may not be ready for.

I’ve experienced both sides of this decision. Early in my journey, I took on SBA loans and signed personal guarantees because I believed debt would fast-track my success. Instead, it weighed my business down, made it harder to pivot when markets shifted, and added stress at every turn.

I see the same pressure play out for consultants I work with now. Not because they lack funding, but because they make decisions based on urgency instead of strategy. Unclear positioning. Too many expenses too early. Foundational mistakes that quietly compound and pull attention away from what actually builds momentum.

In this guide, I will provide a clear breakdown of when business debt might serve you and when it’s better to grow without it.

If you prefer a visual overview, the video below walks through my experience and key takeaways.

Why Business Owners Ask This Question So Often

The idea that growth requires capital is everywhere. It’s easy to assume that if you want to succeed, you’ll need a financial runway through loans, investors, or credit cards. But for consultants and service-based business owners, that mindset often creates more roadblocks than opportunity:

Venture funding often isn’t designed for service-based businesses like consulting.

Business loans taken without proof of concept can lead to unnecessary risk and stress .

So the crucial question isn’t whether you need capital, it’s whether your offer and market are strong enough to support it.

What Debt Taught Me About Agility

I once had a thriving brick-and-mortar business bringing in millions. On the surface, it looked like everything was working. But when the market shifted, I couldn’t move fast enough to adjust because I had debt stacked on top of unpredictable cash flow. What I thought was “good debt” became a constraint. It slowed down my decisions, limited options, and kept me in a model that no longer fit.

That experience changed everything. I realized sustainable growth starts not with money, but with clarity. You don’t borrow to grow, you borrow after you've validated your path. Clarity in your offer means clarity in your choices.

And if you're unsure how to build that clarity, start with building your confidence. This will be your strongest asset.

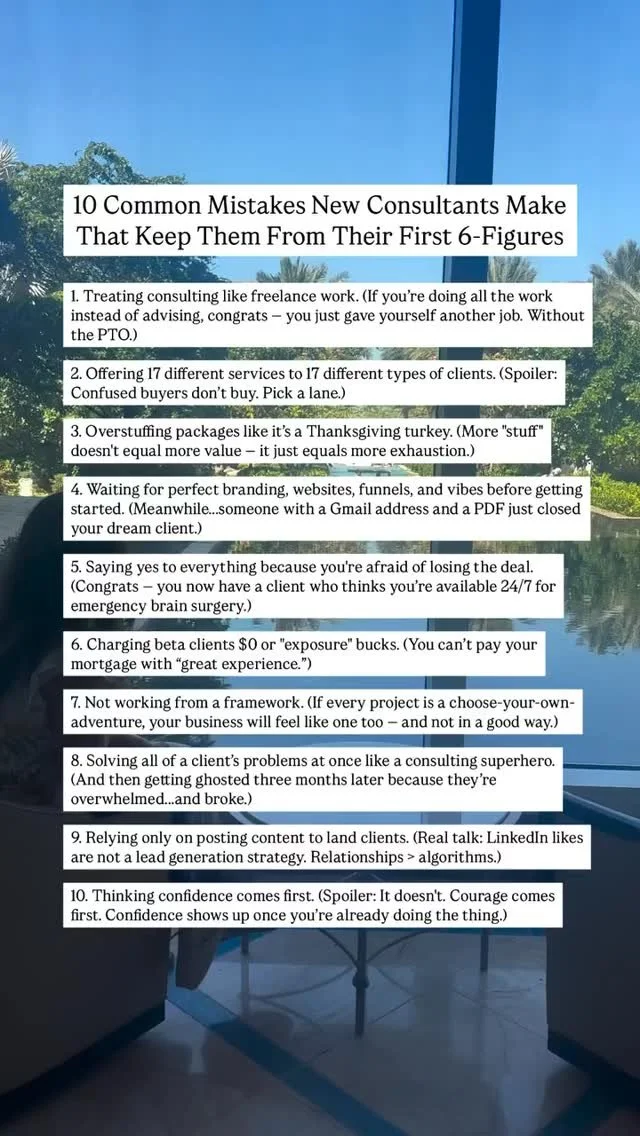

Mistakes That Can Lead You Into Debt Too Early

It’s not the idea of debt that gets most business owners into trouble, it’s the timing. Too often, borrowing starts before the business has a clear direction. Here are two common patterns I see that can quietly create pressure before real traction begins.

Borrowing Before You Have a Real Offer

One of the most common mistakes I see is entrepreneurs borrowing money before they’ve settled on a clear offer. Without a solid package that speaks to what your audience wants, capital can be spent on the wrong things: high-priced programs, flashy tools, complicated funnels…all before revenue starts rolling in.

A prime example is the “high-ticket coaching” trap. It’s easy to believe that spending big on mentorship or mastermind programs will shortcut the process. But when the promised transformation depends on someone else’s advice, not your own validated offer, it quickly becomes risky. Add in heavy payments, and you’re no longer investing in your business, you’re servicing someone else’s deliverables.

Before even considering a loan or investor capital, focus on:

Defining your core consulting offer: who you serve, what you provide, and why it matters

Testing that offer in informal sales conversations or early client work

Tracking early revenue and feedback to shape your next steps

If you want help crafting a high-value, sellable offer without over-investing prematurely, my Consulting Offer Accelerator walks you through the process from positioning to pricing and sales.

Taking on Debt Without Revenue or Proof of Concept

Taking on debt when you don’t yet have revenue or proof of concept creates a perfect storm. Suddenly, your business is racing to make repayments before it even has a functioning model. That kind of pressure forces decisions based on cash flow, not strategy. It can lead to underpricing, overpromising whatever it takes to cover the payments.

Instead of rushing, consider focusing on early traction through small, intentional wins:

A one-off consulting package sold to a real client

A short-term project that delivers measurable results

Incremental pilot offers used to refine process and pricing

That kind of early success gives you real data to build on and much more negotiating power when seeking resources later on. Strong consultants often begin by delivering one small, well-priced offer and reinvesting the results before scaling or adding capital.

Smart Uses of Debt (If You’re Ready)

Now, one thing I want to be clear on: not all debt is created equal. It isn’t always a red flag. When your business is already working and growth is being held back by clear, solvable bottlenecks, debt can be a tool to support what’s already gaining traction. But it only makes sense if you’re on solid ground.

So how do you know if you’re ready? Here are three scenarios where taking on debt may support smart, strategic growth.

You Have Consistent Cash Flow

If your business already generates steady income and you're bottlenecked by logistics, borrowing might make sense to increase capacity, not to build from scratch.

Hiring help: Whether it’s a virtual assistant or contractor, support can allow you to focus on revenue-generating work.

Improving operations: Strategic investments like scheduling tools, CRM systems, or upgraded tech can remove friction and free up your time.

Buying equipment: If you know you’re turning down business because you lack the tools to deliver, this kind of investment could pay off quickly.

The key difference? You’re not gambling. You’re resourcing growth that’s already happening, not using debt to manufacture momentum that isn’t there.

You See a Measurable Return

Growth-stage debt should come with clear math, not hopeful projections. Before taking on a loan or line of credit, ask:

Will this investment generate revenue directly or free up time that can be monetized?

What’s the payback period and does it fit within your current margin?

Have I proven this strategy already, even in a small way?

For example, if investing in a contractor would help you take on two more clients each month and your systems are ready for it, that’s a return you can map. You want debt to expand something real, not fund something hypothetical.

You’re Consolidating High-Interest Payments

If you've already borrowed but your current structure is weighing you down, refinancing or consolidating may help you stabilize. Lowering interest rates or streamlining multiple payments into one can make a big difference in your margin and stress level.

This isn’t about borrowing more, it’s about buying yourself back some breathing room. When done thoughtfully, restructuring frees up cash to reinvest where it matters most.

How to Grow Without Debt

Growing without debt means you’re investing in what works, using proven strategies, lean operations, and smart reinvestment. Here’s how to build a business that scales without loans.

Start With the Tools You Already Have

If you’re just getting started, the focus should be on revenue, not branding, not fancy tools, and definitely not overhead. Your knowledge is your greatest asset. Use it.

Here’s where to start:

Reach out to your network: The first few clients usually don’t come from ads or cold outreach, they come from people who already know you. Let your contacts know what you’re offering and how you can help. You don’t need a big launch. You just need one conversation that leads to a yes.

Package what you already know into an offer: Start by turning your experience into a clear solution someone would pay for. Whether it’s marketing strategy, operations, or leadership, what you know is valuable when it’s packaged to solve a specific problem.

Deliver great results and build from there: Their results, testimonials, and referrals will create the momentum you need to grow, no ads, debt, or scale strategies required at this stage. Focus on outcomes, not perfection.

Avoid getting distracted by infrastructure or shiny tools. Branding, fancy websites, or expensive software can wait until after your offer is validated and revenue is consistent.

Use Low‑Cost Resources and Content

There’s never been a better time to build a business affordably. You don’t have to spend thousands on courses or programs to get started, you just need the right information and a clear plan.

Free content you can learn from right away: You don’t have to spend thousands to get good advice. There are many content creators out there who share valuable frameworks and strategies on YouTube for free (I share a lot of content on my channel The Abundant Consultant in case you want to check it out). Whether you're refining your offer or thinking through your next step, it’s a helpful place to start.

Affordable guides and ebooks: Sometimes all you need is a clear plan. A step-by-step guide can help you turn your expertise into a simple, sellable offer.

Light-touch support: Templates, checklists, and mini-courses can help you move forward without overcommitting.

The point isn’t to piece together a business with scraps, it’s to start smart. Focus on resources that move you forward, not ones that overwhelm or overextend you. A few solid tools, applied consistently, can take you a long way. Keep things simple, build momentum, and let each step fund the next.

Reinvest Profits As You Go

One of the most effective ways to grow is to reinvest what you earn. Debt can seem like a shortcut, but without a proven offer, it usually adds pressure instead of progress. A stronger approach is letting results, not speculation, fund your next move.

Here’s how that might look:

Sell your offer: Focus on landing your first few clients. You don’t need a fully built-out program, just a clear outcome, a defined process, and a willingness to deliver value.

Use profits to refine delivery and systems: Once you’ve worked with clients, you’ll see what needs improvement. That’s when it makes sense to invest in better tools, automation, or updated materials, because you’re improving what already works.

Hire once revenue supports it: Support should solve problems, not create pressure. Bring in help when you know what role you need filled and have the revenue to cover it comfortably.

This approach builds traction without financial strain. You’re not guessing. You’re growing based on real results.

And if you’re not sure what to offer yet or wondering how your experience could translate into a consulting business, my ChatGPT prompt is a helpful tool to get started. It walks you through a series of questions designed to surface your most marketable skills and give you clarity around your next move.

By starting lean, leveraging low-cost content, and reinvesting profit as you grow, you build both the clarity and confidence that set the stage for big decisions, without borrowing more than you need.

Build With Clarity, Not Pressure

Debt can be a tool, but it’s not the starting line. What sets successful entrepeneurs apart isn’t access to capital. It’s clarity. Clarity in your offer, your audience, and your next steps. When you have that, you don’t need to borrow belief, you already have proof.

Start with what you know. Focus on offers that solve real problems. Grow from results, not urgency. Whether you’re aiming to hit your first revenue milestone or scale beyond it, the smartest moves come from a foundation you’ve tested and trust.

And if you’re ready to take your next step with support that doesn’t weigh you down, Consulting Fast Track gives you the structure to build without the pressure of high-ticket programs. It’s light-touch, practical, and designed to help you gain traction fast on your terms.

Because your growth shouldn’t depend on debt. It should depend on you and what you’re ready to build next.

FAQ

-

Debt can be helpful, but only when your business is already working. If you’ve validated your offer, have consistent revenue, and know exactly how the money will create a return, debt can be a strategic tool. But if you're still figuring out your positioning or haven’t sold your offer yet, debt often creates more pressure than progress.

-

Use debt to support growth that’s already happening, not to build momentum from scratch. This might mean hiring help to increase capacity, purchasing tools to streamline operations, or consolidating high-interest payments to improve cash flow. Every dollar should go toward something that’s already proven to work.

-

Yes, but it depends on how and when you take it on. A profitable business uses debt as a tool to accelerate results, not to cover gaps caused by unclear offers or unpredictable revenue. If debt helps you expand what’s working without creating strain, it can fit into a profitable model.

-

Absolutely. Many consultants build highly profitable businesses by starting lean, focusing on revenue-generating work, and reinvesting profits as they grow. With the right offer and a few solid systems, it’s entirely possible to scale without loans, investors, or credit cards.

Check Out More Posts Like This…

I’m Laura, a growth strategist and mentor to consultants.

As a serial entrepreneur who has scaled multiple six and seven-figure online and offline companies over the last twenty years, I can genuinely say that consulting is the best industry I’ve ever been in. Not only does it give me the freedom to spend time with my family and do the things I love (hello, tennis!), but working alongside world-changing entrepreneurs on their business strategies is one of the most rewarding roles I’ve had as an entrepreneur. This is a blog where I share my secrets of how to become an in-demand consultant.

Learn a decision making framework to pre-commit priorities, set clear no criteria, and protect your time. Includes scripts and next steps.